Buying Life Insurance in a Qualified Plan

If your high-net-worth clients need a large life insurance policy but don’t want the large out-of-pocket outlay, they may want to consider using their profit-sharing plan contributions to pay life insurance premiums.

How does this strategy work?

Instead of using take-home pay to purchase life insurance protection, your business- owner clients can use their profit-sharing plan contributions to pay life insurance premiums. This can be an especially smart move if they don’t need those assets for retirement income and had planned to pass them on to their beneficiaries anyway. There are certain guidelines associated with these types of transactions: for example, using only 50 percent of the aggregate contributions to purchase whole life insurance or 25 percent to purchase variable, term, or universal life insurance. However, there is also leeway with money that has been in the plan for several years or was rolled into the plan from an IRA.

Strategy in action

- Roy is age 50 and the owner of a C Corporation.

- He plans to remain in the business until age 65 and needs permanent life insurance coverage.

- He’s in the 35 percent marginal income tax bracket.

- He qualifies for a $57,000 maximum contribution to the company’s profit-sharing plan in all years, but does not need that money for retirement income.

- His advisor suggests he purchase an additional $500,000 of life insurance for his family, using contributions to his profit-sharing plan.

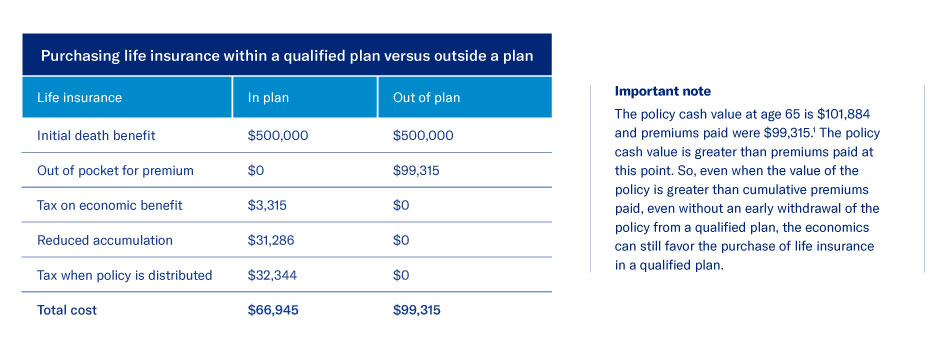

The chart below shows the difference between Roy purchasing life insurance within his qualified plan vs. outside of the plan. Keep in mind that each case is different and variables can change your clients’ results. Each client should consult with their tax advisor prior to implementing this strategy.

1 The policy premium and death benefit amounts used for this case are only intended to help demonstrate the planning concept discussed and not to promote the sale of a specific product. The rates are broadly representative of rates that would apply for a policy of this type and size for insureds of good health in the ages mentioned. To determine how this approach would work with your clients, individual illustrations should be prepared or requested for review. If different rates were used, there might be significantly different results.

Prospective client

- Needs life insurance protection

- Does not need all of plan assets for retirement income; plans to leave qualified plan values to beneficiaries

- May face significant income and estate tax on plan assets

- Is a business owner who wishes to use business dollars to purchase life insurance and has control in setting up or managing their qualified plans

Highlighted product(s) with this concept

VUL Survivorship

See all wealth transfer products

BrightLife® Grow

Client materials

-

Documents to view or email to clients

Financial Professional materials

Please be advised that this webpage is not intended as legal or tax advice. Accordingly, any tax information provided in this article is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed, and your clients should seek advice based on their particular circumstances from an independent tax advisor. Neither Equitable nor its affiliates provide legal or tax advice.

IMPORTANT NOTE:

As this sales approach could be applied in connection with either the sale of a product to fund an ERISA qualified plan, or distributions from retirement accounts (as defined by the Department of Labor’s (DOL) Fiduciary Duty Rule), it may be subject to, or otherwise fall within the context of that rule. Accordingly, you must ensure that any action you take pursuant to this sales approach fully comports with all aspects of the DOL's rule, as determined and approved by your firm's legal, compliance and supervisory policies, procedures and protocols.

Life insurance products are issued by Equitable Financial Life Insurance Company (New York, NY) or Equitable Financial Life Insurance Company of America (Equitable America), an Arizona stock corporation with its main administration office in Jersey City, NY and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable Products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC) (Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC.