A Roth IRA alternative

Cash value life insurance can offer your clients both financial security and a tax-deferred way to accumulate additional funds for retirement that can work similarly to a Roth IRA plan.

Whiteboard video: consider a Roth IRA alternative

How does the strategy work?

When your clients cannot make contributions to a Roth IRA, they may purchase a cash value life insurance policy and make after-tax premium payments. The policy’s cash value grows tax-deferred. After a number of years, when the cash value is high enough, your clients can potentially take tax-free withdrawals from the policy. One of the main differences is that there are no income restrictions for making contributions to a cash value life insurance policy.

Strategy in action

- Mike needs life insurance protection for his family and wants to save more for retirement.

- He and his wife, Robin, earn too much income to contribute to a Roth IRA.

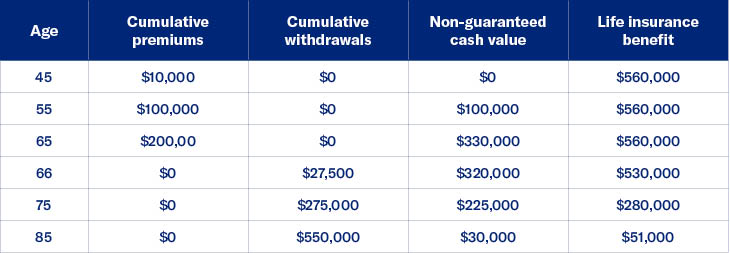

- He purchases a cash value life insurance policy at age 45 and pays $10,000 a year into the policy for 20 years.

- At age 65, Mike could potentially take withdrawals of $32,000 per year from the policy cash value, tax-free, for 20 years, and still keep the policy intact, with a death benefit for his family.

The policy premium and death benefit amounts used for this case are intended only to help demonstrate the planning concept discussed and not to promote any specific product. The values are broadly representative of rates that would apply for a policy of this type and size for the insured’s health and the ages noted in the example and are not guaranteed. To determine how this approach might work for your client, individual illustrations based on their individual age and underwriting class, containing both guaranteed charges and guaranteed interest rates as well as other important information, should be prepared.

Prospective client

- Not married and earning an income of over $118,000

- Married with a joint income of $186,000 or more

- Needs financial protection for family or business

- Has maximized contributions to qualified plans, such as a 401(k)

- Not eligible for Roth IRAs or has already contributed the maximum amount to a Roth IRA

- Looking for a way to save more money for retirement in a way that offers tax-deferred growth and potentially tax-free distributions

Considerations

Please remember cash value life insurance does have many other considerations clients should review carefully before selecting a life insurance policy. Please keep these important points in mind:

- If clients do not keep paying the premium on a life insurance policy, they will lose substantial money in early years.

- To be effective, clients need to hold the policy until death. A life insurance policy generally takes years to build up a substantial cash value.

- Tax-free distributions will reduce cash value and the face amount of the policy. Clients may need to pay higher premiums in later years to keep the policy from lapsing.

- Clients must qualify medically and financially for life insurance, unlike a Roth IRA.

- Generally, there are many additional charges associated with a life insurance policy, including but not limited to a front-end load, monthly administrative charge, monthly segment charge, cost of insurance charge, additional benefit rider costs, and surrender charges.

Highlighted product(s) with this concept

Brightlife® Grow

VUL OptimizerSM

VUL Survivorship

Client Materials

-

Documents to view or email to clients

Under current federal tax rules, clients generally may take federal income tax-free withdrawals up to their basis (total premiums paid) in the policy or loans from a life insurance policy that is not a Modified Endowment Contract (MEC). Certain exceptions may apply for partial withdrawals during the policy’s first 15 years. If the policy is an MEC, all distributions (withdrawals or loans) are taxed as ordinary income to the extent of gain in the policy, and may also be subject to an additional 10% premature distribution penalty prior to age 59½, unless certain exceptions are applicable. Loans and partial withdrawals will decrease the death benefit and cash value of the life insurance policy and may be subject to policy limitations and income tax. In addition, loans and partial withdrawals may cause certain policy benefits or riders to become unavailable and may increase the chance the policy may lapse. If the policy lapses, is surrendered, or becomes an MEC, the loan balance at such time would generally be viewed as distributed and taxable under the general rules for distribution of policy cash values.

Please be advised that this document is not intended as legal or tax advice. Accordingly, any tax information provided in this article is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed, and your clients should seek advice based on their particular circumstances from an independent tax advisor. Neither Equitable Financial nor its affiliates provide legal or tax advice.

Life insurance products are issued by Equitable Financial Life Insurance Company (New York, NY) or Equitable Financial Life Insurance Company of America, an Arizona stock corporation with its main administration office in Jersey City, NJ 07310 and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC)(Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC. When sold by New York based (i.e. domiciled) financial professionals life insurance products are issued by Equitable Financial Life Insurance Company, (NY, NY).