Using life insurance to help preserve income in retirement ("Smooth Sailing")

Market performance in the earliest years can make or break a client's long-term retirement. But, with cash value life insurance, clients can take available withdrawals during down-market years to help preserve their assets.

How does the strategy work?

By purchasing permanent cash value life insurance, your clients can protect their families during their working years, and build enough cash value in the policy to take strategic withdrawals during down-market years in retirement. That way, they don’t lock in market losses and can potentially preserve their assets for a long retirement or to pass along to loved ones.

Strategy in action

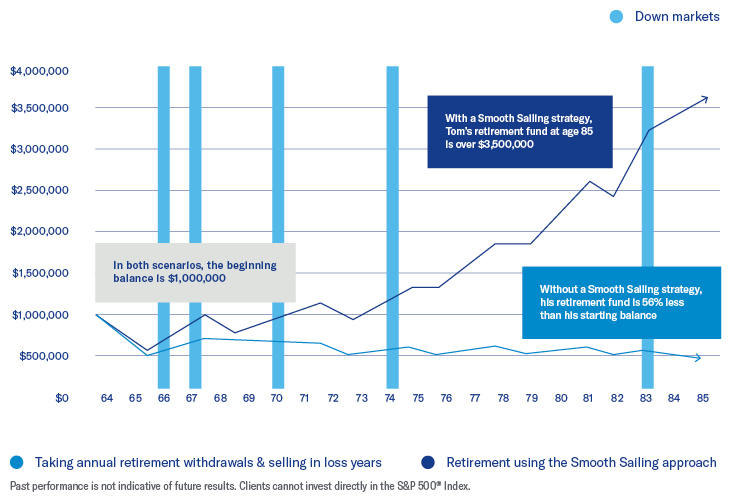

- Tom is 65 and has accumulated $1 million toward his retirement.

- He needs to take $70,000/year in income, but is afraid that taking funds out of his retirement fund every year will lock in losses in down-market years and substantially decrease the value of his portfolio.

- Tom also has a $500,000 cash value life insurance policy that he has adequately funded.

- By accessing the policy’s cash value in years where there is a market loss, Tom preserves his traditional retirement funds so that they can recover.

See the difference between Tom using his cash value life insurance in down-market years and dipping into his retirement assets every year. We assumed the same market performance as the 1970s and 1980s. The gray bars represent the five down-market years during this time, based on returns of the S&P 500® Price Return Index.

The policy premium and death benefit amounts used for this case are intended only to help demonstrate the planning concept discussed and not to promote any specific product. The values are broadly representative of rates that would apply for a policy of this type and size for the insured’s health and age. Here, it is assumed that the insured has an underwriting class of preferred non-tobacco and pays 20 years of premiums of $6,967 from ages 45-65. To determine how this approach might work for your client, individual illustrations based on their age and underwriting class, containing guaranteed charges and guaranteed interest rates as well as other important information, should be prepared.

Prospective client

- Has a need for life insurance.

- Is 40-60 years old and is saving for retirement.

- Traditional savings options, like IRAs and 401(k)s, may not be enough.

- Is concerned about retirement assets, given the market’s instability in recent years, and what might happen if the market drops during his or her retirement years.

Considerations

- Withdrawal rates are subject to debate among planners. The withdrawal rate shown here may or may not be appropriate for your client’s specific situation. In some instances, a lower withdrawal rate may be appropriate; in other instances, this may be an appropriate withdrawal rate.

- This example is based on a hypothetical scenario where Tom receives low and negative early returns. Past performance is not predictive of future performance; clients’ actual results will be different. If it turns out that the market is strong in clients’ early years of retirement, they will have directed funds to life insurance premiums and may not need to access the cash values.

- If clients are able to actually achieve strong early-year returns, they won’t have the same risk related to their retirement funds, but they will have a life insurance death benefit and its cash values to enhance their overall financial goals. This strategy is intended to address the concerns clients might have if they don’t receive strong early returns.

- There is usually a surrender charge that will vary by type of policy. These charges usually run 15 years or longer and will affect the available amount clients have to withdraw or borrow from their policy at any given time. There are also cost of insurance and other policy charges that will impact their cash value.

- The strategy presented here is intended to reflect a broad concept, and individual situations will be different. In certain cases, clients will not have complete flexibility with all assets.

- In many instances, IRA and qualified plan assets will require minimum distributions after age 72. This will force assets out of retirement funds even in years following market losses.

- How much life insurance clients can purchase and the price they pay will depend on medical and financial underwriting.

- To make this strategy effective, clients will need a long-term buy and hold strategy with a cash value life insurance policy.

Highlighted product(s) with this concept

BrightLife® Grow

VUL Survivorship

See all accumulation products

Client materials

-

Documents to view or email to clients

Financial professional materials

-

Marketing materials

S&P®, Standard & Poor’s®, S&P 500® and Standard & Poor’s 500TM are trademarks of Standard & Poor’s and have been licensed for use by Equitable.

Loans and withdrawals reduce the policy’s cash value and death benefit and may increase the change a policy may lapse. The client may need to pay higher premiums in later year to keep the policy from lapsing.

Please be advised that this webpage is not intended as legal or tax advice. Accordingly, any tax information provided is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed, and clients should seek advice based on their particular circumstances from an independent tax advisor. Neither Equitable nor its affiliates provide legal or tax advice.

Life insurance products are issued by Equitable Financial Life Insurance Company (New York, NY) or Equitable Financial Life Insurance Company of America (Equitable America), an Arizona stock corporation with its main administration office in Jersey City, NY and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable Products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC) (Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC.