Using permanent life to fund a Retirement Buy-Sell

Business co-owners may need cash to transition their company or use for retirement income. This strategy can help.

How does this strategy work?

A Retirement Buy-Sell arrangement, funded by permanent life insurance, can help business co-owners make sure that they, their families and their business are set up for the future, even if one of the co-owners:

- Passes away unexpectedly

- Becomes disabled

- Decides to get out of the business

- Retires

Unlike a buy-sell funded by term insurance, which simply provides a benefit if one of the co-owners dies, a Retirement Buy-Sell offers the flexibility to address the owner’s changing needs over time. That includes the potential to provide cash value for supplemental retirement income.

To set up a Retirement Buy-Sell:

- Each business owner must own a life insurance policy on themselves, with the face amount equal to their portion of the business. They pay their own premiums, often with a bonus from the business.

- To make it a “buy-sell” some or all of the death benefit is “endorsed” or “rented” to the other business owners as a way for them to temporarily “own” a piece of the death benefit. This gives them the ability to collect that money if the insured passes away.

- Each owner has access to their policy’s cash surrender value.

- With the cash value, they can fund a buy-out of the business if one owner decides to leave or they can use it as supplementary retirement income if the business is sold and the buy-sell is no longer needed.

- If they want to protect against a long-term care event, they can apply to purchase a long-term care rider on the policy as well.

Strategy in action

Nathan (age 50), Zach (age 45) and Alex (age 40) are brothers and own a business appraised at $6 million, with the value estimated to double over the next decade. To give themselves maximum flexibility and protection, and keep the business in the family, they decide to set up a Retirement Buy-Sell arrangement.

- Each brother purchases a $3 million life insurance Indexed Universal Life policy on himself, with the Long-Term Care ServicesSM Rider.

- Each owner endorses $2.0 million to each of the other two co-owners and receives a rental cost from the other two.

Here’s what happens over the next 25 years…

- At age 60, Nathan passes away. His death benefit passes to Zack and Alex, so they can purchase Nathan’s shares of the business from his estate. Zack’s and Alex’s each have a cost basis in the business now equal to the purchase price ($1.5 million).

- At age 65, Zack has health issues and can no longer work. Alex and Zack sell the business for $5 million, so each receives a $2.5 million (at 5% interest with a 10-year balloon) note from the new owner.

- At age 70, Zack needs to go into assisted living facility. He uses the long-term care benefits from the life policy to pay for his care. His wife lives off the payments from the business.

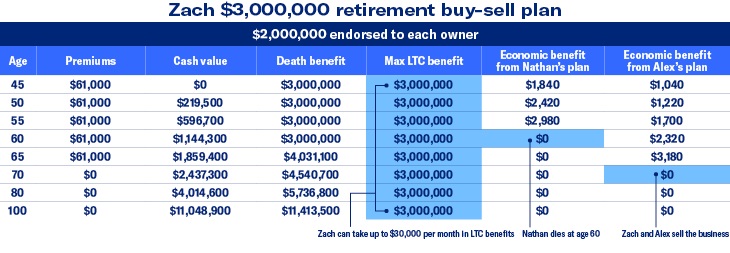

Strategy in action - Zach

See how permanent life insurance helps the surviving brother, Zach…

*The Retirement Buy-Sell is no longer in effect.

This is a supplemental illustration and must be read in conjunction with the basic illustration. The basic illustration contains values using the same underwriting assumptions as this supplemental at both guaranteed charges and guaranteed interest rates and contains other important information. The values represented here are for a $3,000,000 BrightLife® Grow policy on a 45-year-old male preferred non-smoker. The values reflect the cost of 20 years of premiums. The values represented here are non-guaranteed and assume current charges and a current interest rate of 5.79%. If guaranteed rates and charges are used, the policy would fail in year 17.

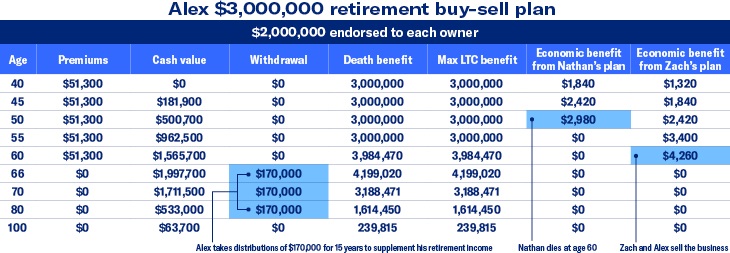

Strategy in action – Alex

See how permanent life insurance helps the surviving brother, Alex…

* The Retirement Buy-Sell is no longer in effect.

This is a supplemental illustration and must be read in conjunction with the basic illustration. The basic illustration contains values using the same underwriting assumptions as this supplemental at both guaranteed charges and guaranteed interest rates and contains other important information. The values represented here are for a $3,000,000 BrightLife® Grow policy on a 45-year-old male preferred non-smoker. The values reflect the cost of 20 years of premiums. The values represented here are non-guaranteed and assume current charges and a current interest rate of 5.79%. If guaranteed rates and charges are used, the policy would fail in year 19.

Prospective client

- Co-owner of a business

- Wants to plan for business transition

- Needs retirement income as well

- Wants to plan for potential long-term care expenses

Highlighted products with this concept

BrightLife® Grow

Client materials

-

Documents to view or email to clients

Financial Professional materials

-

Marketing materials

The Long-Term Care ServicesSM Rider is available for an additional cost and does have restrictions and limitations. Be sure to review the product specifications for further details. A client may qualify for the life insurance but not the rider.

BrightLife® Grow is issued in New York and Puerto Rico by Equitable Financial Life Insurance Company (Equitable), New York, NY and in all other jurisdictions by Equitable Financial Life Insurance Company of America (Equitable America), an Arizona Stock Corporation with its main administrative office in Jersey City, NJ, and is distributed by Equitable Network, LLC and Equitable Distributors, LLC, New York, NY. Life insurance products are issued by Equitable Financial Life Insurance Company (New York, NY) or Equitable Financial Life Insurance Company of America and co-distributed by affiliates Equitable Network, LLC and Equitable Distributors.

Please be advised that this webpage is not intended as legal or tax advice. Accordingly, any tax information provided is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed, and clients should seek advice based on their particular circumstances from an independent tax advisor. Neither Equitable nor its affiliates provide legal or tax advice.