Reward key employees with an executive bonus plan

Standard benefits may not be enough to attract, retain, and reward your clients’ key employees. An executive bonus plan, funded with life insurance, can provide substantial benefits for both employer and employee.

How does this strategy work?

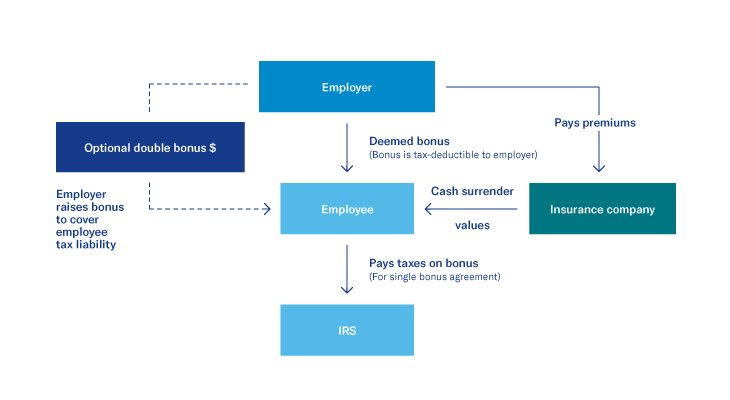

The employer can offer a permanent life insurance policy to certain key employees. The key employee owns the policy and the cash value and can select a beneficiary to receive the life insurance benefit at his or her death. The employer pays the policy premiums as a bonus to the employee. The bonus is taxable to the employees and income tax-deductible to the business if the compensation is reasonable. The employee can use the cash value for retirement and the life insurance protection for his or her family.

Strategy in action - while a key employee is living

- The employer pays the policy premiums and receives a current income tax deduction, provided the compensation is reasonable.

- The key employee includes the amount of the premiums paid by the employer as gross income.

- The key employee can potentially receive income tax-free withdrawals and loans from the cash surrender value – using that money for retirement or other purposes.1

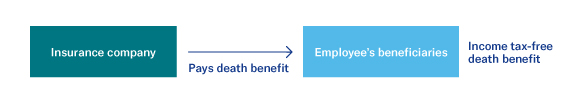

Strategy in action - upon employee's death

- The proceeds are received income tax-free by the beneficiary.

Prospective client

- Businesses with highly compensated key employees

- Small businesses with 20 or more employees

- Businesses with a desire to provide additional benefits to key employees

- Any corporate entity, including S corporations and partnerships with non-owner key employees

Highlighted product(s) with this concept

BrightLife® Grow

VUL OptimizerSM

Client materials

-

Documents to view or email to clients

Financial Professional materials

1 Under current federal tax rules, clients generally may take income tax-free withdrawals up to their basis (total premiums paid) in the policy or loans from a life insurance policy. If the policy is a modified endowment contract (MEC), all distributions (withdrawals or loans) are taxed as ordinary income to the extent of gain in the policy and may also be subject to an additional 10 percent premature distribution penalty prior to age 59½, unless certain exceptions are applicable. Withdrawals reduce the policy’s cash value and death benefit and increase the chance that the policy may lapse.

Please be advised that this webpage is not intended as legal or tax advice. Accordingly, any tax information provided in this article is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed, and your clients should seek advice based on their particular circumstances from an independent tax advisor. Neither Equitable nor its affiliates provide legal or tax advice.

Life insurance products are issued by Equitable Financial Life Insurance Company (New York, NY) or Equitable Financial Life Insurance Company of America (Equitable America), an Arizona stock corporation with its main administration office in Jersey City, NY and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable Products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC) (Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC.