How much life insurance do they need?

If your clients aren’t sure how much life insurance they need, you can – quickly and easily – perform a capital needs analysis, using a simple form.

How does this strategy work?

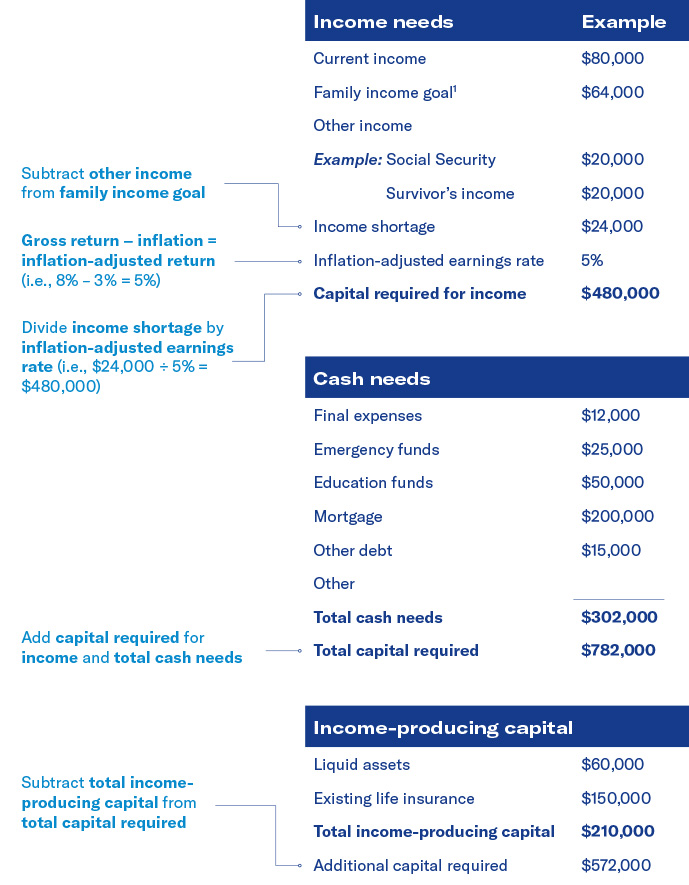

Using a simple form, you and your clients will fill in income and cash needs for each spouse, as well as any income-producing capital they might have. This will help you figure out how much capital they would need if either of them passed away unexpectedly and how much life insurance protection would cover that need.

Strategy in action

You sit down with a client and fill out the following worksheet. His current income is $80,000 but his family could live on $64,000 a year (80% of his income) if something were to happen to him. In the end, you decide that he’ll need another $572,000 in life insurance to protect his family.

Tips for a successful meeting

- Make sure that both spouses are present and involved in the process

- Be transparent – answer all questions as thoroughly as possible, without using industry jargon

- Make it interactive – encourage both spouses to give their opinions and ask questions

- Use their goals and assumptions – be sure to ask enough questions to get the information you need

Highlighted product(s) with this concept

VUL LegacySM

See all permanent protection products

Term Series

Client materials

-

Documents to view or email to clients

1 Assumed replacement of 80% of current income in this example, but can be adjusted to meet client’s goals.

This life insurance needs analysis is a tool that can help clients estimate their life insurance needs. The information provided is not a substitute for a complete life insurance needs analysis. This information is not a guarantee of coverage. The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance.

Life insurance products are issued by Equitable Life Insurance Company (NY, NY) or Equitable Financial Life Insurance Company of America (EFLOA), an Arizona stock corporation and are co-distributed by affiliates Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC) (Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC. When sold by New York based (i.e. domiciled) Equitable Advisors financial professionals life insurance is issued by Equitable Financial Life Insurance Company (NY, NY).