Protection for stay-at-home parents

Your clients may not immediately see the need for life insurance on a stay-at-home parent. However, let them take a look at the price of replacing all the services they provide and they might decide the protection is worthwhile.

How does the strategy work?

One of the most common needs that your clients may overlook is the need to insure the life of a stay-at-home parent. Show your clients how much it would cost to fulfill the obligations that a stay-at-home parent has, and then show them how little term life insurance can cost in comparison. They may find that a small cost each month is worth a lifetime of security.

Strategy in action

If stay-at-home parents were paid for all the jobs they perform each day -- tutoring, cooking, nursing, housekeeping, bookkeeping, etc. – it is estimated they’d work 92 hours a week and earn $178,201 a year.1 What if they were no longer alive and someone else had to fulfill those services?

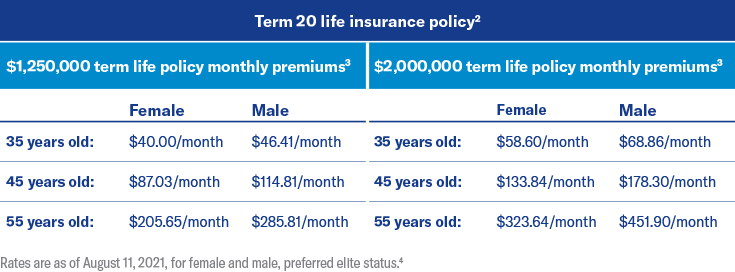

Now, look at how little it would cost to provide financial protection for their families, if something should happen to them:

Wouldn’t it be worthwhile to cover the stay-at-home parent, so the family will have the financial support they need?

Highlighted product(s) with this concept

Term Series

Client materials

-

Documents to view or email to clients

1 Source: www.salary.com/articles/mother-salary/

2 Rate quoted is for Term 20 life insurance, which is issued by Equitable Financial Life Insurance Company (NY, NY). Individuals may not qualify for this underwriting class, which will result in a higher premium. Rates are guaranteed for the level term period selected, and are based on insurance carrier guidelines with regard to build, blood pressure, cholesterol, family and personal medical history, etc. Applications are subject to medical and non-medical underwriting and insurance carrier approval.

3 Monthly premiums are not allowed except for special billing – i.e., systematic draft from checking account or salary allotment.

4 This refers to Equitable’s most favorable rating class. Rates quoted may not be available in all states. Eligibility for these classes will vary and are subject to underwriting. Policy form 156-LT or ICC144-156-LT. Equitable has sole responsibility for its life insurance and annuity obligations. Certain types of policies, features and benefits may not be available in all states. Life insurance contains exclusions, limitations and terms for keeping it inforce.

Equitable and its affiliates offer a broad Term life insurance portfolio, including Annual Renewable Term (ART), 1-Year Term (TermOne®) and Level Term (Term 10, Term 15 and Term 20). Life insurance is subject to exclusions, limitations and terms for keeping it inforce. Term Series life insurance products are issued by Equitable Financial Life Insurance Company (Equitable), New York, NY 10104 or Equitable Financial Life Insurance Company of America (Equitable America). Co-distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR); and Equitable Distributors, LLC. TermOne® is a registered service mark of Equitable.