Using life insurance as an asset

If your clients are uneasy about the market, they may want to consider using life insurance as an asset to help stabilize and transfer their wealth regardless of market performance.

How does this strategy work?

By directing a small percentage of their overall net worth or income each year to pay life insurance premiums, your clients can leverage their dollars into a relatively large life insurance benefit generally income tax free. This can allow them to pass assets on to their family or beneficiaries and hedge against the risk of low market returns. Especially in the early years,1 life insurance death benefits can offer substantially more than the hypothetical investment. As time goes on, the leverage offered by life insurance may be reduced as the non-life insurance assets grow and compound.

Strategy in action

- Helen is a 60-year-old widow.

- She has a portfolio2 of $3,000,000 in real estate and equities.

- She wants to make sure her children and grandchildren receive a meaningful inheritance, but she is concerned that her assets may underperform if left in the market.

Helen’s financial professional suggests she take $30,000 each year (1 percent of her accessible assets) and direct the funds to a life insurance policy on her life. As a result, she may purchase a life insurance benefit of $2,400,000. Her portfolio is reduced each year by the amount of the policy’s costs, but the life insurance benefit gives her a potentially more effective transfer strategy.

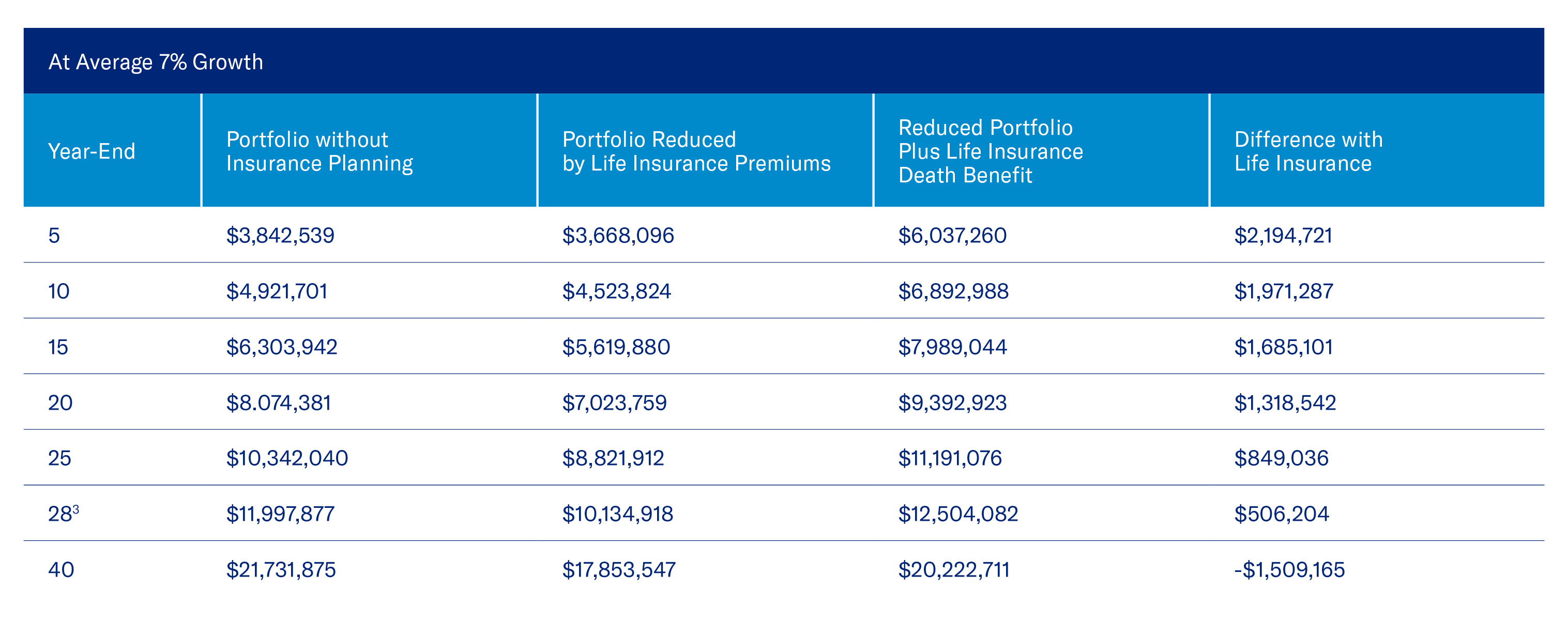

The following chart compares Helen’s portfolio with and without the life insurance policy. As you can see, in the early years, the policy creates a large life insurance benefit in relation to the amount of premiums paid.

Prospective client

- Older clients with a large portfolio invested in the stock market

- Concerned about market declines

- Want to pass assets on to loved ones in a tax-efficient way

Considerations

Although using life insurance as a part of a wealth transfer strategy may make sense, your clients should weigh this against other considerations relative to their long-term financial strategy.

Points to consider include:

- By purchasing a life insurance policy, clients will consume a portion of assets that might otherwise grow in an investment portfolio. Although life insurance has the potential to offer leverage in the early years, leaving the premium dollars in a portfolio might provide more to their beneficiaries over time. This is particularly true if clients live beyond their life expectancy. Clients should not dedicate excessive amounts of their assets to life insurance. Instead, consider life insurance as only one aspect of their overall financial picture.

- The effectiveness of this technique depends on the underlying pricing assumptions in the life insurance policy. Should the life insurance fail to meet the pricing assumptions, or should clients live significantly beyond their life expectancy, the anticipated death benefit may not provide their beneficiaries with the anticipated leverage.

- Clients’ ability to purchase life insurance is conditioned by financial and medical underwriting. Based on their overall medical and financial profile, the total amount of life insurance protection they might be able to purchase could be limited or cost prohibitive.

- Generally, there are many additional charges associated with a life insurance policy, including but not limited to a front end load, monthly administration charge, cost of insurance charge, additional benefit rider costs and surrender charges.

Highlighted product(s) with this concept

VUL Survivorship

Client materials

-

Documents to view or email to clients

Financial Professional materials

-

Marketing materials

1 Generally, this refers to the first 20-30 years. The number of years will vary depending on the client’s age, underwriting class, premium payments, and other factors.

2 This portfolio represents a 50% Income/50% Appreciation portfolio allocation that is primarily made up of real estate and equities.

3 This year indicates life expectancy based on the 2008 VBT Mortality Table.

Please be advised that this document is not intended as legal or tax advice. Accordingly, any tax information provided in this article is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed, and your clients should seek advice based on their particular circumstances from an independent tax advisor. Neither Equitable Financial nor its affiliates provide legal or tax advice.

Life insurance products are issued by Equitable Financial Life Insurance Company (New York, NY) or Equitable Financial Life Insurance Company of America (Equitable America), an Arizona stock corporation with its main administration office in Jersey City, NY and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable Products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC) (Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC.